|

Getting your Trinity Audio player ready...

|

We know about the millions and billions lost to theft, corruption, maladministration, and other widely publicised causes – but what about the more insidious loss of similar amounts to the undeclared movement of taxable funds across borders?

On 25 July the Tax Justice Network (TJN) published its annual State of Tax Justice report, and at the same time issued a dire warning that unless swift action is taken, over the next 10 years countries will lose nearly US$5-trillion in tax abuse because of the dodgy dealings of multinational corporations and wealthy individuals using tax havens to avoid paying what is due by them.

This future loss, says TJN, would be equivalent to losing a year of worldwide spending on public health.

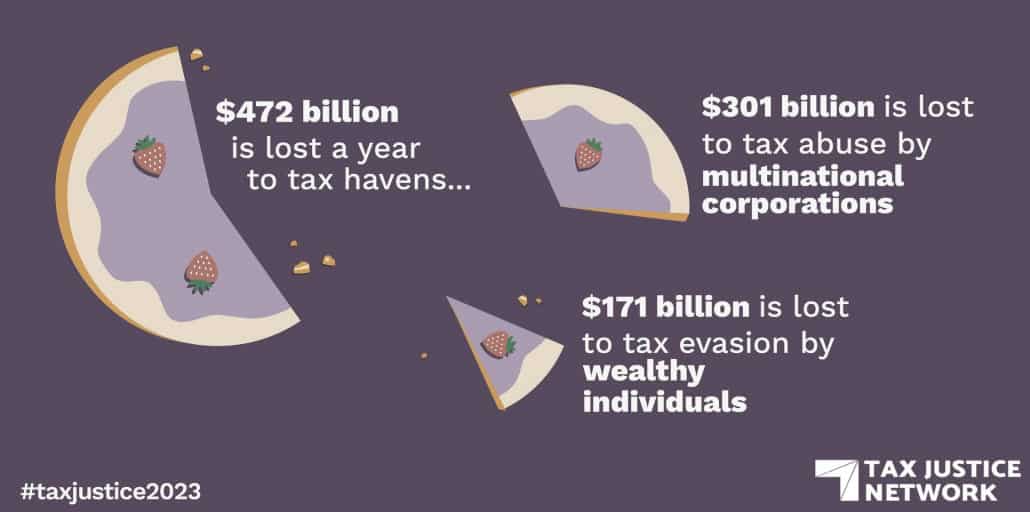

As it is, the organisation found annual tax losses of US$472-billion worldwide in the current reporting period.

The State of Tax Justice reports how much each country in the world loses in tax each year to cross-border corporate tax abuse by multinational corporations and private tax evasion by private individuals.

The report also recaps each country’s ranking on TJN’s Corporate Tax Haven Index and Financial Secrecy Index, as well as each country’s vulnerability to illicit financial flows as tracked by the Tax Justice Network’s vulnerability tracker.

“While tax may be overlooked, and even unloved, in reality it is our social superpower. Tax allows us to choose to organise our communities, at the local and national level, so that we can all live better lives, together,” says Irene Ovonji-Odida, TJN chairperson.

While the largest losses in absolute terms are borne by major economies and higher income countries ($426 billion), says TJN, lower income countries endure by far the deepest losses ($46-billion) when considered as a share of current tax revenues, or current spending on vital public services such as health and education.

So while the loss incurred by higher income countries amounts to 9% of their public health budgets, it is a different story in lower income countries, whose loss is equivalent to 56% of their public health budgets.

“In countries at all income levels, those who already find themselves most marginalised economically and socially will bear the brunt.”

OECD failing to stem the tide

The bulk of tax abuse (US$301-billion) is committed by multinationals, while just US$171-billion is lost to the actions of wealthy individuals who wish to hide their wealth in other jurisdictions.

TJN is pushing for regulation of the global tax network to transfer to the UN, as it argues that the OECD – which sets the rules governing international taxation for multinationals through its Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations – is failing to curb tax evasion and illicit financial flows. In the 10 years since it began its efforts to reform global tax, the OECD has achieved no significant reductions in the amount lost to global tax abuse – on the contrary, says TJN, it is blocking tax reform.

“It boils down to one number: US$4.7-trillion,” says TJN. “That is how much tax we estimate wealthy corporations and individuals will avoid and evade over the next decade under the current direction of OECD tax leadership.”

On the other hand, the organisation adds, countries can gain the same amount by adopting the anti-tax abuse standards which “the OECD has long resisted – standards that can only be won through democratic process at the UN.”

A UN tax convention coupled with a global tax body under UN auspices – this is the key to ending cross-border tax abuse, says TJN, as it has the potential to set global rules and standards to eliminate the scope for cross-border tax abuse.

“The people of every country stand to be empowered, with governments increasingly able to exercise their sovereign power so that tax can play its central role as a social superpower.

In December, countries will vote on whether to forge ahead with this initiative. “Countries have a choice to make at the UN this year end. Forfeit our future now by staying the course, or democratise global tax rules so we can hold on to the public money we need for the challenges ahead,” says TJN CEO Alex Cobham.

South Africa loses big to tax abuse

South Africa’s economy is in dire straits and its people are also struggling, with a third of the population unemployed, according to Statistics South Africa, which reported an unemployment figure of 32.9% in the first quarter of 2023 – among the highest in the world. According to the Quarterly Labour Force Survey, this is a 0.2% increase compared to the fourth quarter of 2022.

Yet the country is allowed to lose an average of $1 893 945 477 each year to tax havens – a staggering sum of money that is desperately needed for development and redress.

This is equivalent to 1.7% of the country’s tax revenue, says TJN, or $33 for every single South African citizen. So great is the amount that it easily tops the $1 303 698 684 of Russia, a country with more than twice South Africa’s population.

While this works out to less than the global average tax revenue loss of 2.8%, as well as the regional average tax revenue loss of 2.2%, it is revenue that South Africa can ill afford. As with the global situation, the bulk of the loss – around $1-billion – was committed by multinational corporations, while private individuals got away with $528-million in unpaid tax.

TJN equates this loss to 8.30% of South Africa’s education spending, or a shocking 10.50% of the country’s health budget.

As far as vulnerability to illicit financial flows is concerned, the most recent data for South Africa (2018) put it at 66 on a scale of 0 to 100, where 100 is worst. The country is most vulnerable to irregularities in the inward trade in minerals.

A saving grace for South Africa is that TJN calculates the tax loss the country inflicts on other countries as $0.