|

Getting your Trinity Audio player ready...

|

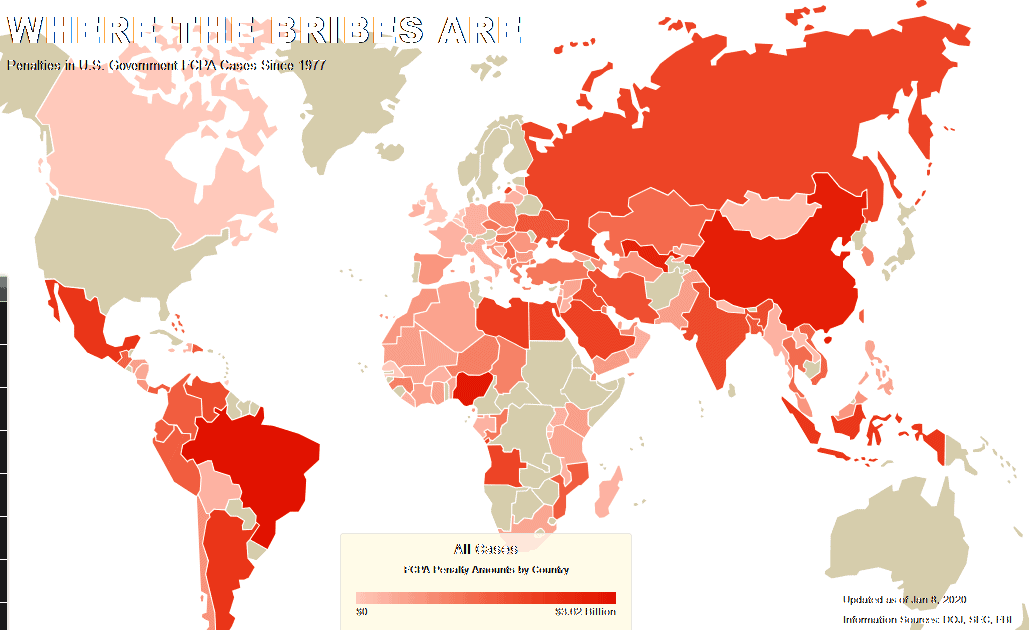

South Africa is one of numerous countries listed on an interactive online map of cases brought against and penalties paid by companies in Foreign Corrupt Practices Act (FCPA) cases. The FCPA is a US law that prohibits companies from securing or retaining business abroad by means of bribery.

The map, titled Where the Bribes Are, lists penalties imposed since 1977. It was published in 2011 by due diligence and investigations firm Mintz Group, and is kept current with FCPA developments. According to the map, a total of almost US$20-billion has been paid in settlements to date, across eight sectors – infrastructure ($3.83-billion), energy ($6.31-billion), manufacturing ($823.46-million), defense and aerospace ($1-billion), consulting and miscellaneous ($2.82-billion), health and pharmaceuticals ($1.39-billion), telecommunications ($3.71-billion), and agriculture ($114.51-million).

The map features information on virtually every FCPA violation around the world and graphically identifies areas of risk for companies doing business overseas. It also identifies companies and government sources associated with cases filed.

In South Africa’s case, however, just one successful penalty has been imposed in all the years. The country has been grappling with high levels of corruption for decades, but accountability and consequences for perpetrators has been thin on the ground. In contrast, countries such as China and Mexico have seen numerous cases brought and massive penalties imposed.

Worldwide, the energy sector is the hardest hit, with penalties of over $6-billion imposed across the globe. The largest in that sector to date was that of Brazil’s Petrobras, which, according to a settlement agreement reached in September 2018 with the US Securities and Exchange Commission (SEC), agreed to pay a total of $933-million in interest and an $853-million penalty.

In Nigeria in 2015, engineering and construction company Kellogg Brown & Root pleaded guilty to FCPA-related charges for its participation in a decade-long scheme to bribe Nigerian government officials to obtain engineering, procurement and construction contracts. As part of the plea agreement, the firm agreed to pay a $402-million criminal fine.

Meagre FCPA success in South Africa

South Africa’s single successful FCPA-related case was in the infrastructure sector, and involved Japanese conglomerate Hitachi, which in 2015 was charged by the SEC with violating the FCPA when it inaccurately recorded improper payments to the ANC in connection with contracts to supply boilers to the two multi-billion-dollar power plants Medupi and Kusile.

The two contracts were worth $2.9-billion and $2.7-billion respectively. According to the SEC, Hitachi was aware that Chancellor House was a front company for the ANC during the bidding process but chose to continue to partner with the company, and to encourage it to use its political influence to help obtain government contracts from Eskom.

The payments, said by the SEC to be success fees, were recorded by Hitachi as consulting fees and amounted to around $1-million.

This marked the SEC’s first successful FCPA – and to date, only – settlement in South Africa. Two previous FCPA investigations into companies operating in South Africa, Net 1 UEPS Technologies (2012) and Gold Fields (2013), were dropped in 2015.

Hitachi agreed to pay $19-million to settle the SEC charges. At the time there was concern that the settlement was a mere drop in the ocean for a company of Hitachi’s size and, in fact, some described the fine as ‘laughable’.

The fact that South Africa only has one successful FCPA case to its name is not a good thing, for it means that companies that violate the FCPA are not being penalised. This signifies a culture of no accountability for acts of corruption.

With the map serving to provide a visual way for companies to assess the risk of corruption in the countries where they operate or hope to operate, lack of prosecution and sanctions does not indicate lack of corruption – rather, the opposite.